Acourt in the United Kingdom declared Indian fugitive businessman Vijay Mallya bankrupt on Monday.

This will pave the way for a consortium of Indian banks led by the State Bank of India (SBI) to pursue a worldwide freezing order to seek repayment of debt owed by Vijay Mallya’s now-defunct Kingfisher Airlines by seizing his Indian assets.

I adjudicate Dr Mallya bankrupt,” Chief Insolvencies and Companies Court Judge Michael Briggs said during a virtual hearing of the Chancery Division of the London High Court.

The consortium of Indian banks had argued for the bankruptcy order to be granted in their favour. They were represented by law firm TLT LLP and barrister Marcia Shekerdemian.

ALSO WATCH: Banks recover another Rs 792 crore by selling Vijay Mallya’s shares

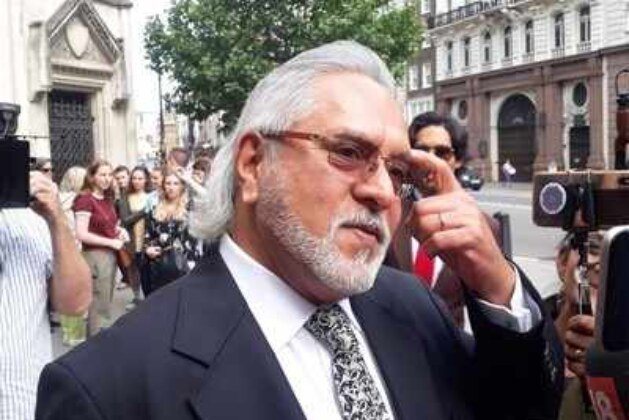

Meanwhile, 65-year-old Vijay Mallya remains on bail in the UK. A ‘confidential’ legal matter, perhaps related to an application for asylum, is yet to be resolved in connection with unrelated extradition proceedings.

Vijay Mallya’s barrister Philip Marshall sought a stay and adjournment of the bankruptcy order as long as legal challenges remain ongoing in Indian courts. But the judge turned down these requests and concluded there was “insufficient evidence” that the debt would be paid back to the petitioners in full within a reasonable time period.

Additionally, an application seeking permission to appeal against the bankruptcy order was given. Judge Briggs refused this as well, stating that there was “no real prospect of success” of the appeal.

WHO ARE THE PETITIONERS?

The petitioners in this case consist of a consortium of 13 banks that include SBI, Bank of Baroda, Corporation bank, Federal Bank Ltd, IDBI Bank, Indian Overseas Bank, Jammu & Kashmir Bank, Punjab & Sind Bank, Punjab National Bank, State Bank of Mysore, UCO Bank, United Bank of India and JM Financial Asset Reconstruction Co. Pvt Ltd.

The petitioners also included an additional creditor who had been pursuing a bankruptcy order in the UK in relation to a judgment debt which stands at more than GBP 1 billion.

Vijay Mallya’s legal team held that the debt remains disputed and the ongoing proceedings in India obstructed a bankruptcy order from being granted in the UK.

The debt in question comprises both the principal and interest amount, plus compound interest at the rate of 11.5 per cent per annum from June 25, 2013 onwards.Vijay Mallya has submitted applications in India to contest the compound interest charges.

Leave a comment

You must login or register to add a new comment.